In the mid-2000s, BlackBerry was a titan in the mobile industry. Once hailed as the gold standard in business communication, it boasted unmatched security, a physical keyboard adored by professionals, and a user base that included presidents, CEOs, and top government officials. Yet, within a decade, BlackBerry went from industry leader to near-obsolescence. The question many business analysts continue to ask is: What went wrong?

This article delivers a detailed analysis of the defining strategic missteps, missed market cues, and internal challenges that contributed to the fall of this once-dominant tech brand. As a cautionary tale, it underscores the importance of adaptability in a fast-evolving technological landscape.

BlackBerry’s Rise: Built on Innovation and Security

Founded in 1984 as Research In Motion (RIM) by Mike Lazaridis and Douglas Fregin, the Canadian company initially focused on wireless data technologies. By the early 2000s, BlackBerry had established itself as a pioneer in mobile email and enterprise communication. Its first major success came with the BlackBerry 850, a two-way pager, which paved the way for more advanced smartphone models.

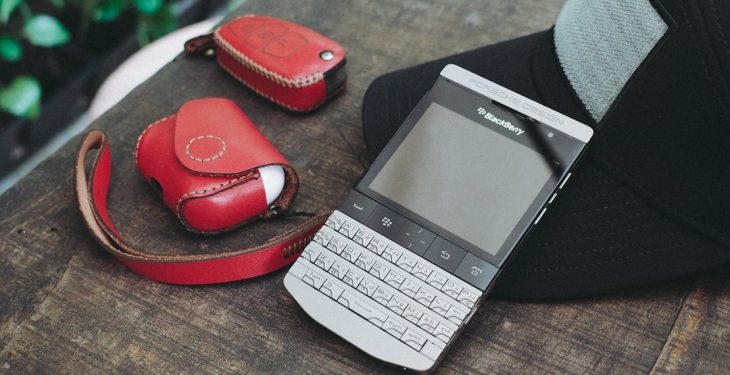

With encrypted messaging and the fully tactile QWERTY keyboard, BlackBerry devices were ideal for secure corporate communication. Its reputation for security and reliability quickly transformed it into a status symbol among business elites.

At its peak, BlackBerry commanded over 50% of the U.S. smartphone market and about 20% of the global market. However, this dominance created an illusion of invincibility that would later prove costly.

The Turning Point: A Refusal to Accept Consumer Trends

The release of Apple’s iPhone in 2007 initiated a paradigm shift in the smartphone industry. What was once a tool primarily for business users became a high-powered personal device—with intuitive touchscreens, vibrant app ecosystems, and versatile multimedia capabilities. While competitors like Samsung and HTC took advantage of this transformation, BlackBerry chose to remain laser-focused on its corporate niche.

Here were some key assumptions BlackBerry executives made—and where they went wrong:

- People Wanted Keyboards: BlackBerry leadership believed consumers and professionals alike would never give up physical keyboards. They underestimated how touchscreens, combined with autocorrect and interface evolution, could replace the tactile typing experience.

- Security Alone Was Enough: RIM put heavy emphasis on security as a sustained differentiator. While still critical in regulated industries, mainstream consumers prioritized functionality, design, and user experience more than end-to-end encryption.

- Apps Didn’t Matter: Possibly their most significant miscalculation. BlackBerry failed to realize that third-party applications were about to revolutionize mobile computing. While Apple launched the App Store in 2008, BlackBerry’s app store, rolled out much later, was sparse and hard to develop for. Developers found it clunky to use, so they jumped ship to Android and iOS.

Internal Mismanagement and Stagnant Innovation

BlackBerry’s executive leadership, particularly co-CEOs Mike Lazaridis and Jim Balsillie, came under scrutiny for creating a culture resistant to external ideas. Innovations from within were often delayed, poorly marketed, or released too late to make a difference. Other internal problems included:

- Lack of Unified Vision: A dual-CEO structure led to conflicting priorities and muddled corporate direction.

- Poor Developer Relations: Developers were frustrated with BlackBerry’s operating system, which was fragmented and difficult to code for, further undermining the company’s already shallow app ecosystem.

- Insufficient Marketing: While iPhone commercials focused on aspirational lifestyle branding, BlackBerry continued targeting a limited, business-centric demographic, alienating younger users and casual consumers.

Critical Misses in Product Execution

As iPhones and Android phones surged in popularity, BlackBerry tried to pivot—but the execution was weak. The Storm, its first touchscreen phone in 2008, landed with a thud. Rushed to market and riddled with bugs, it paled in comparison to the iPhone’s fluid interface. Then came the PlayBook tablet, which launched without email capability—a baffling omission for a company built on communication reliability.

The 2013 launch of BlackBerry 10, a new operating system designed to compete with Android and iOS, was too little, too late. Its interface confused users, and the device itself lacked the ecosystem users had come to expect. By this point, the momentum had shifted decisively toward iOS and Android.

The App Gap: Ignoring the Developer Community

BlackBerry’s failure to establish a thriving ecosystem is perhaps the most underappreciated cause of its decline. The company never opened up in a way that invited app developers to its platform with ease. It held on to its proprietary systems, making it difficult for developers to create and port apps.

In contrast, both Apple and Google introduced robust API toolkits and marketplaces that encouraged both big and small developers to invest in their platforms. The absence of apps meant users found BlackBerry phones increasingly restrictive and outdated, further accelerating the decline in sales.

Reputation Takes a Hit

By the mid-2010s, BlackBerry was associated not with innovation, but with missed opportunities. Even in its traditional strongholds—the enterprise and government sectors—iPhones and Android alternatives began replacing BlackBerrys. The perception shifted: what was once a cutting-edge tool now felt obsolete or even embarrassing to carry.

Security breaches, including a high-profile disruption in 2011 that left millions of users without email or messaging for days, also undermined trust. The brand’s key selling point had been compromised.

Attempts at a Turnaround

BlackBerry appointed John Chen as CEO in 2013 to oversee a transition from hardware to software, especially security software. This pivot helped stabilize the company financially, but it came too late to save the phone division. By 2016, BlackBerry announced it would stop manufacturing phones altogether and would license the brand name to third-party vendors.

Although BlackBerry as a software and cybersecurity company still exists today, its core identity as a phone maker is now a footnote, remembered with equal parts nostalgia and regret.

Lessons from the Collapse

The story of BlackBerry offers vital lessons for businesses in any sector:

- Adapt Or Perish: Relying on past success can blind an organization to present risks. Market dynamics can change rapidly, and reluctance to adapt can be catastrophic.

- Customer-Centric Approach is Non-Negotiable: No matter how strong a product is, it must respond to the changing needs and behaviors of its users. Companies that fail to listen, innovate, and adjust will fall behind.

- Internal Culture Matters: A bureaucratic, risk-averse culture can stifle innovation and agility at precisely the moment when reinvention is necessary.

Conclusion

BlackBerry’s downfall is not just the story of a failed product but a broader parable of hubris, misjudgment, and missed opportunities in the face of disruptive change. For companies navigating the rapid technological evolution of today, the BlackBerry saga remains a stark warning: dominance is fleeting, and survival depends on the ability to evolve.